Today I want to tackle the issue of investing in equities markets as a way to participate in grow your wealth and build that retirement nest egg.

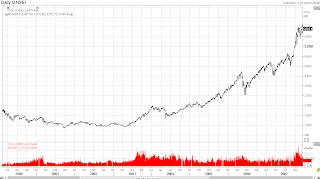

Let us look at a chart to kick off things;

This is where NIFTY was in the good old days. Where your avuncular broker told you to buy whatever stock has an uptick for three days straight. In this kind of market even my grandmother would have made money. Just BUY!

Nifty opened at 1091 on Jan 2003 and at 6274 on Jan 2008. That is a cumulative return of 54.8%. Just think about that kind of return. No wonder people got so horny about stocks in that period. The basic assumption of that argument was that the returns would continue in the future. That is the growth rate would continue to an indefinite time.

Now here is the chart that shows what happened since 2007.

Basically zero returns. Yes, since 2008, NIFTY has returned zero in five years. That is if you were brave(?) enough to hold it throughout the five year period! One may argue that NIFTY being a price return index does not take the dividends into account. To them, all I can say is the dividend yield is approximately 1.5% for Nifty in a country where inflation is pretty high. So. I guess, dividends are not that big a deal in this discussion. You would expect a good degree of growth to be attributable to the price appreciation rather than dividends.

Now think again about what many felt in 2005-2007 era. That equities are a good source to grow wealth did not work over the last five years sadly.

Would there be a reversal of fortunes up ahead? Let us atleast look at the drivers of the last bull run and whether those factors are relevant now and the major issues that need to be addressed first.

Let us look at a chart to kick off things;

This is where NIFTY was in the good old days. Where your avuncular broker told you to buy whatever stock has an uptick for three days straight. In this kind of market even my grandmother would have made money. Just BUY!

Nifty opened at 1091 on Jan 2003 and at 6274 on Jan 2008. That is a cumulative return of 54.8%. Just think about that kind of return. No wonder people got so horny about stocks in that period. The basic assumption of that argument was that the returns would continue in the future. That is the growth rate would continue to an indefinite time.

Now here is the chart that shows what happened since 2007.

Basically zero returns. Yes, since 2008, NIFTY has returned zero in five years. That is if you were brave(?) enough to hold it throughout the five year period! One may argue that NIFTY being a price return index does not take the dividends into account. To them, all I can say is the dividend yield is approximately 1.5% for Nifty in a country where inflation is pretty high. So. I guess, dividends are not that big a deal in this discussion. You would expect a good degree of growth to be attributable to the price appreciation rather than dividends.

Now think again about what many felt in 2005-2007 era. That equities are a good source to grow wealth did not work over the last five years sadly.

Would there be a reversal of fortunes up ahead? Let us atleast look at the drivers of the last bull run and whether those factors are relevant now and the major issues that need to be addressed first.